Do you have enough equity in your home for the down payment on your next purchase? Here’s how to find out.

It’s true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. Home sales prices in the Kansas City Metro have risen 9.6% in the last year alone.

That’s really great for your home’s value over the last year or so, but what if you’ve lived in your home for longer than that? You may be wondering how much equity you truly have. The National Association of Realtors (NAR) recently conducted a study to calculate typical gains over longer spans of time. While the national data below may give you enough motivation to move, you’ll want to get a professional assessment from a trusted local realtor to find out just how much equity you have in your specific home.

Let’s take a look at the NAR’s study in which they calculate the typical gains over longer spans of time. But first, we need to establish how you build equity in your home. Price appreciation is clearly a factor, but don’t forget that you also build equity as you pay down the principal on your home loan.

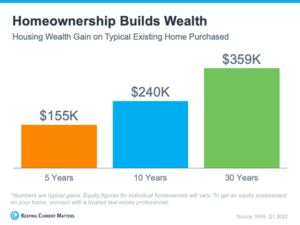

The study from NAR breaks down the typical gain over time (see graph below). It calculates the equity a homeowner potentially gained if they purchased the median-priced home 5, 10, or 30 years ago and still own it today.

These numbers are certainly impressive and may be enough to help fuel a move into your next home, but they’re not a promised amount. Remember, your own equity gain will be different, depending on how long you’ve been in the house, your home’s condition, any upgrades you’ve made, your area, school district, and much more.

If you’re thinking about selling your house and making a move, home equity can be a real game-changer, especially if you’ve been in your current home for a while. To find out how much equity you have, partner with a trusted local real estate professional for an assessment on your home. They can provide an expert opinion on what your house is worth today and how the equity you’ve gained over time can help you on the purchase of your next home. It may be some (if not all) of what you need for your next down payment.