Courtesy of

MBS Road Signs 12-26-23

Week of December 18, 2023 in Review

The Fed’s favored inflation measure continues to move lower toward its 2% target while falling mortgage rates boosted existing home sales and new construction. Don’t miss these stories:

- Inflation Inching Closer to Fed’s 2% Target

- Existing Home Sales End 5-month Skid

- New Home Sales Plunge to Lowest Level in a Year

- “Improving Housing Conditions” in 2024

- Housing Starts Hit 6-Month High

- Initial Jobless Claims at 2-Month Low

Inflation Inching Closer to Fed’s 2% Target

Inflation Inching Closer to Fed’s 2% Target

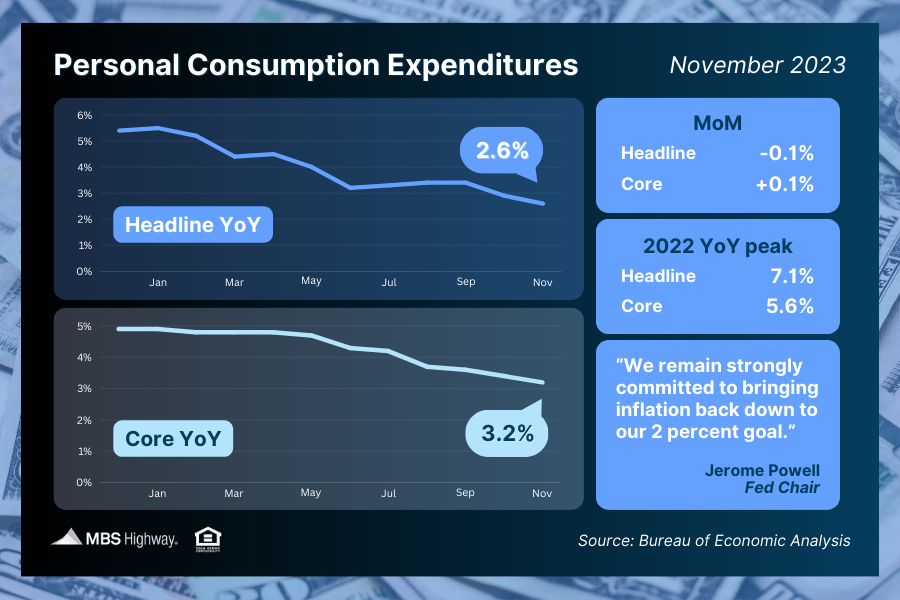

November’s Personal Consumption Expenditures (PCE) showed that headline inflation fell 0.1% for the month, with the year-over-year reading down from 2.9% to 2.6%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.1% in November. The year-over-year reading fell from 3.4% to 3.2% – the lowest level in more than two years.

What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading at 2.6% (down from 7.1%) and the core reading at 3.2% (down from 5.6%). Plus, annualizing the last six months’ worth of readings puts Core PCE at 1.85%, which is below the Fed’s 2% target!

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation.

Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years.

Existing Home Sales End 5-month Skid

Existing Home Sales End 5-month Skid

The Fed did not hike at their last three meetings, so they could continue to assess incoming inflation, labor sector and other economic data. While the Fed has not ruled out additional rate hikes if warranted to keep inflation in check, they have suggested that rate cuts are ahead. After this month’s meeting, the “dot plot” of Fed member forecasts for where policy rates will be in a year showed that 15 out of 19 members expect cuts between 50 and 100 basis points over the course of next year.

After falling for five consecutive months, Existing Home Sales rose 0.8% from October to November to a 3.82-million-unit annualized pace. per the National Association of REALTORS® (NAR). However, sales remain 7.3% lower than they were in November of last year due in part to persistent low inventory and elevated mortgage rates.

There were 1.13 million homes available for sale at the end of October, which is below healthy levels at just a 3.5 months’ supply at the current sales pace. This low level of inventory remains supportive of home prices, as Lawrence Yun, NAR’s Chief Economist noted that, “Only a dramatic rise in supply will dampen price appreciation.”

What’s the bottom line? This report measures closings on existing homes in November and likely reflects people shopping for homes in September and October, when rates peaked. Sales are expected to pick up even further in the coming months as rates have started to improve.

On that note, Yun added that, “The latest weakness in existing home sales still reflects the buyer bidding process in most of October when mortgage rates were at a two-decade high before the actual closings in November. A marked turn can be expected as mortgage rates have plunged in recent weeks.”

New Home Sales Plunge to Lowest Level in a Year

New Home Sales Plunge to Lowest Level in a Year

New Home Sales, which measure signed contracts on new homes, plunged 12.2% from October to November to a 590,000-unit annualized pace. This disappointing reading was well below expectations and follows several strong months of contract signings.

What’s the bottom line? Elevated mortgage rates clearly kept some buyers on the sidelines last month, yet rates have declined in recent weeks, which should help spur more contract signings in upcoming reports.

Improving Housing Conditions in 2024

“Improving Housing Conditions” in 2024

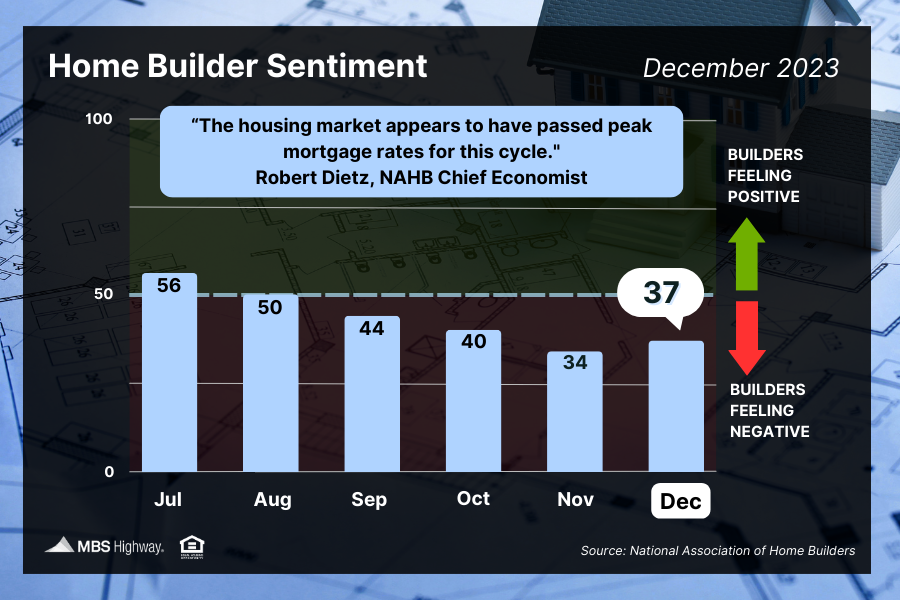

Confidence among home builders ended a four month slide this month as falling mortgage rates led to a rise in buyer traffic and an overall improvement in builder sentiment. The National Association of Home Builders (NAHB) Housing Market Index rose three points to 37, and while this is still in contraction territory below the key breakeven level of 50, the reversal marks a positive sign heading into next year.

In terms of the index components, current sales conditions held steady at 40, while future sales expectations increased six points to 45 and buyer traffic rose three points to 24.

What’s the bottom line? NAHB Chief Economist Robert Dietz noted that, “The housing market appears to have passed peak mortgage rates for this cycle.” Plus, there was additional good news for buyers, as more builders (36%) reported cutting prices, matching November’s level for the highest percentage in a year.

Housing Starts Hit 6-Month High

Housing Starts Hit 6-Month High

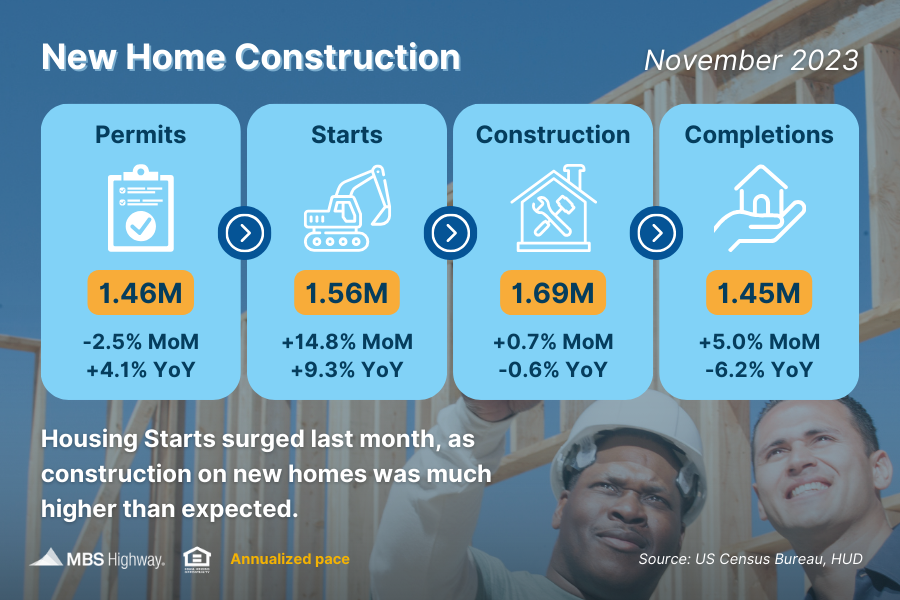

Builders scaled up production for both single-family and multi-family projects last month as Housing Starts (which measure the start of construction on homes) were well above expectations, surging 14.8% from October to the highest level since May. While Building Permits, a sign of future construction, ticked lower in November, single-family permits hit their highest level in a year.

What’s the bottom line? Alicia Huey, NAHB Chair, noted that, “Lower interest rates and a lack of resale inventory helped to provide a strong boost for new home construction in November.”

Yet, even with the uptick in Housing Starts, more supply is still needed to meet demand.

When we consider the pace of completed homes that will be coming to market (around 1.5 million homes annualized) and subtract roughly 100,000 homes that need to be replaced every year due to aging, we’re well below demand as measured by household formations that are trending at 1.9 million as of the end of September.

More demand than supply will continue to be supportive of home values, especially when we reach the busier spring homebuying season next year.

Initial Jobless Claims Remain Tame

Initial Jobless Claims inched higher by 2,000 in the latest week, with 205,000 people filing for unemployment benefits for the first time. Continuing Claims were relatively flat, falling by 1,000 as 1,865,000 million people are still receiving benefits after filing their initial claim.

What’s the bottom line? The low number of Initial Jobless Claims suggests that layoffs remain muted as employers are trying to hold on to workers. Yet, Continuing Claims have been trending higher and point to a weakening labor market, where it’s much harder for people to find employment once they are let go.

What to Look for This Week

After the market closures Monday for Christmas, more housing news closes out the last week of 2023. On Tuesday, we’ll see an update on home price appreciation for October via Case-Shiller and the Federal Housing Finance Agency. November’s Pending Home Sales will be reported on Thursday along with the latest Jobless Claims.

Technical Picture

Mortgage Bonds ended last week trading in a sideways pattern, just above support at the 101.392 Fibonacci level. The 10-year has been in a beautiful downtrend, falling from the peak around 5% to 3.89%. Yields seem destined to move down to test the next floor of support at 3.76%.