Fed Still Signals Three Rate Cuts in 2024

After eleven rate hikes since March of 2022, the Fed once again left their benchmark Federal Funds Rate unchanged at a range of 5.25% to 5.5%. This decision was unanimous and marks the fifth straight meeting they held rates steady.

The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. The Fed has been aggressively hiking the Fed Funds Rate throughout this cycle to try to slow the economy and curb the runaway inflation that became rampant over the last few years.

What’s the bottom line? Despite some recent inflation readings that were hotter than expected, the Fed noted that three rate cuts are still expected this year. The Fed’s “dot plot” of member forecasts showed that 15 out of 19 members still expect cuts of between 50 and 100 basis points over the course of 2024.

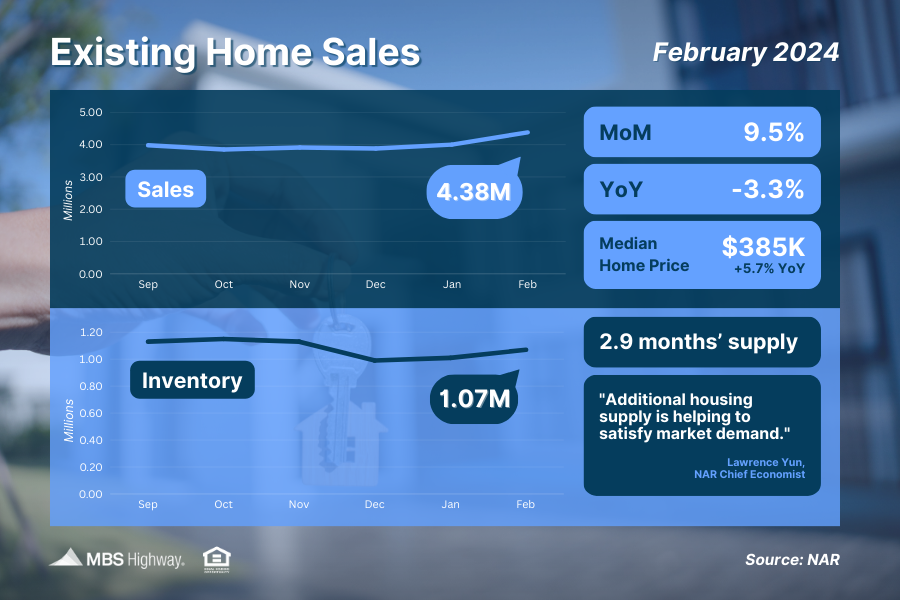

Existing Home Sales Hit Highest Level in a Year

Existing Home Sales jumped 9.5% from January to February to a 4.38-million-unit annualized pace, reaching their highest level in a year per the National Association of REALTORS (NAR). This report measures closings on existing homes in February and likely reflects people shopping for homes in December and January, when rates were improved from last fall’s peak.

What’s the bottom line? Inventory increased 5.9% from January, with NAR’s Chief Economist Lawrence Yun noting that “additional housing supply is helping to satisfy market demand.”

Rising inventory is certainly a step in the right direction to help improve the persistent tight housing supply we’ve seen across the country. However, the 1.07 million homes available for sale at the end of February is still below healthy levels at just a 2.9 months’ supply of homes at the current sales pace. Yun added that “more supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences.”

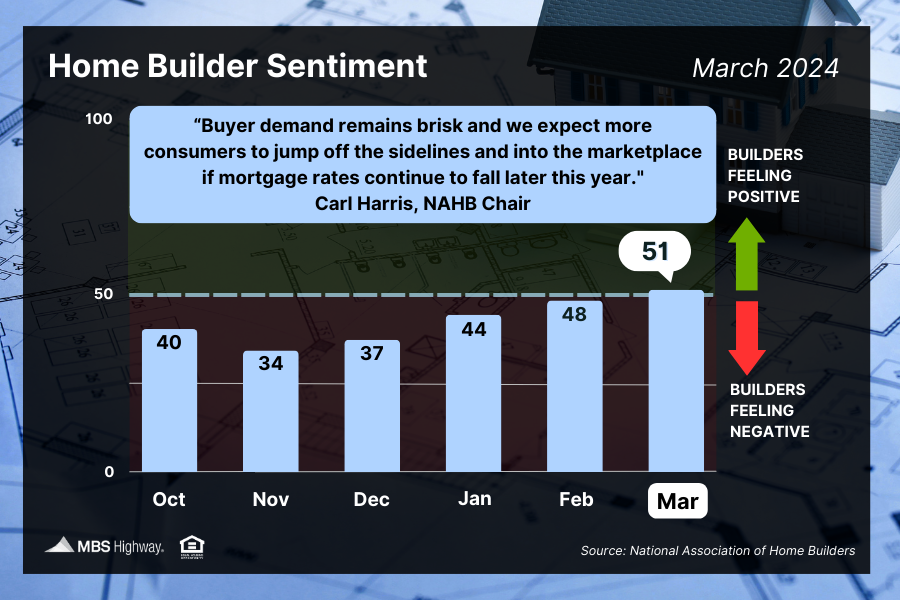

Home Builders Feeling Positive

Confidence among home builders broke above the key breakeven threshold of 50 and into positive territory for the first time since last July, per the National Association of Home Builders (NAHB). Their Housing Market Index climbed three points to 51 in March, which was also the fourth consecutive monthly gain. Any score over 50 on this index, which runs from 0 to 100, signals that more builders view conditions as good than poor.

All three index components posted gains this month, with current and future sales expectations both well into expansion territory at 56 and 62, respectively. The gauge judging buyer traffic also moved higher.

What’s the bottom line? The persistent lack of previously owned homes for sale, strong buyer demand, and rates below last fall’s peak have pushed builder confidence higher. NAHB Chair Carl Harris explained, “Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year.”

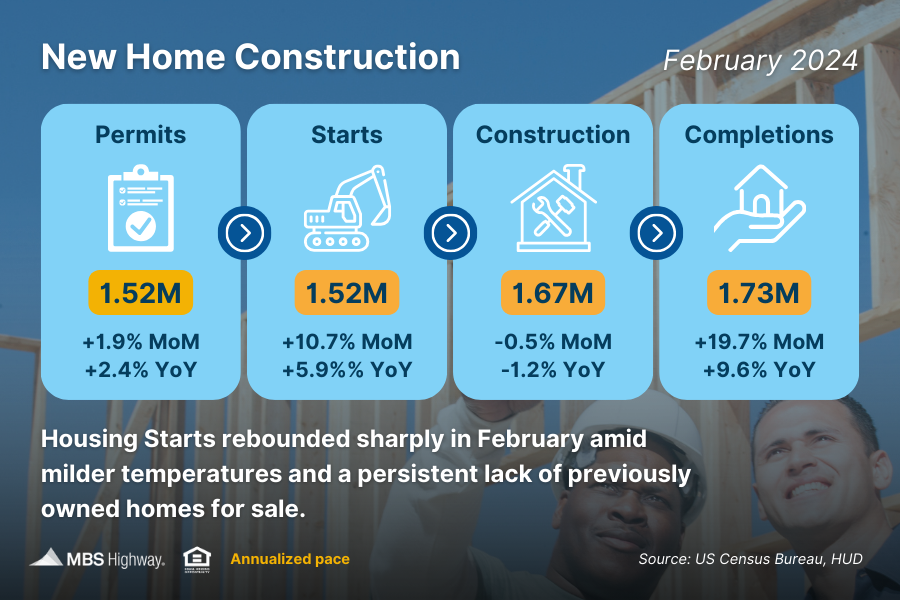

Favorable February for Housing Starts

Housing Starts saw a big rebound in February, with both single-family and multi-family construction improving from January’s slump. When compared to a year ago, however, single-family starts were up 35.2% while multi-family starts were down 35.9%. This suggests that we’re seeing a shift from multi-family to single-family construction, which is welcome news as this is where supply is needed around much of the country.

Single-family Building Permits also reached their highest level in a year, up 29.5% when compared to February 2023, signaling that the numbers for future supply are also favorable.

We also saw a big boost in completions, and if the current pace continues, this will add a further boost to much needed supply.

What’s the bottom line? Danushka Nanayakkara-Skillington, NAHB’s Assistant VP for Forecasting and Analysis, confirmed that “single-family housing is poised for a good year in 2024 with starts and permits on an upward trend.”

Chair Carl Harris added, “The solid level of single-family production in February tracks closely with rising builder sentiment, and with mortgage rates expected to moderate further this year, this will provide an added boost for single-family building.”

What to Look for This Week

We’ll get an update on signed contracts for February when New and Pending Home Sales data is released on Monday and Thursday, respectively. Plus, appreciation data for January from Case-Shiller and the Federal Housing Finance Agency will be reported on Tuesday.

Look for the final reading for fourth quarter 2023 GDP and the latest Jobless Claims on Thursday. Friday brings what will likely be the biggest news of the week – the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds broke above their 50-day Moving Average last Friday, which was a positive technical development. The 10-year has broken beneath its 25-day and 100-day Moving Averages, ending last week battling the formidable 200-day Moving Average, which could be difficult to break through.