Newsletter – 4/8/2024

Week of April 1, 2024 in Review

March Job Gains Roared in Above Estimates

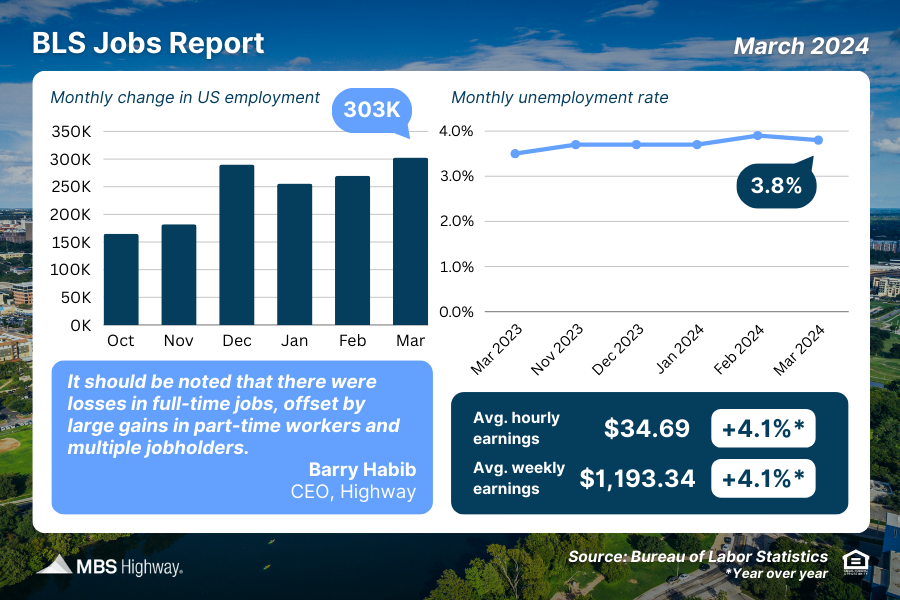

The Bureau of Labor Statistics (BLS) reported that there were 303,000 jobs created in March, which was much stronger than expectations of 200,000 new jobs. Revisions to January and February added 22,000 jobs in those months combined. However, losses in full-time jobs were offset by gains among part-time workers and multiple job holders.

The unemployment rate fell from 3.9% to 3.8%. It has remained in a narrow range between 3.7% and 3.9% since last August.

What’s the bottom line? The Fed has a dual mandate of price stability and maximum employment. When inflation became rampant a few years ago, they began aggressively hiking their benchmark Fed Funds Rate (the overnight borrowing rate for banks) to slow the economy and reduce pricing pressure.

After their eleventh hike last July, the Fed paused further hikes as inflation cooled. And while inflation has fallen considerably after peaking in 2022, the progress toward the Fed’s 2% target as measured by Core Personal Consumption Expenditures has slowed.

Given the Fed’s dual mandate, a cooling job market is the other factor that could pressure them to cut the Fed Funds Rate sooner rather than later. However, the overall strength of March’s Jobs Report, including the falling unemployment rate, will likely not add any pressure to their timeline.

Jump in ADP Job Numbers

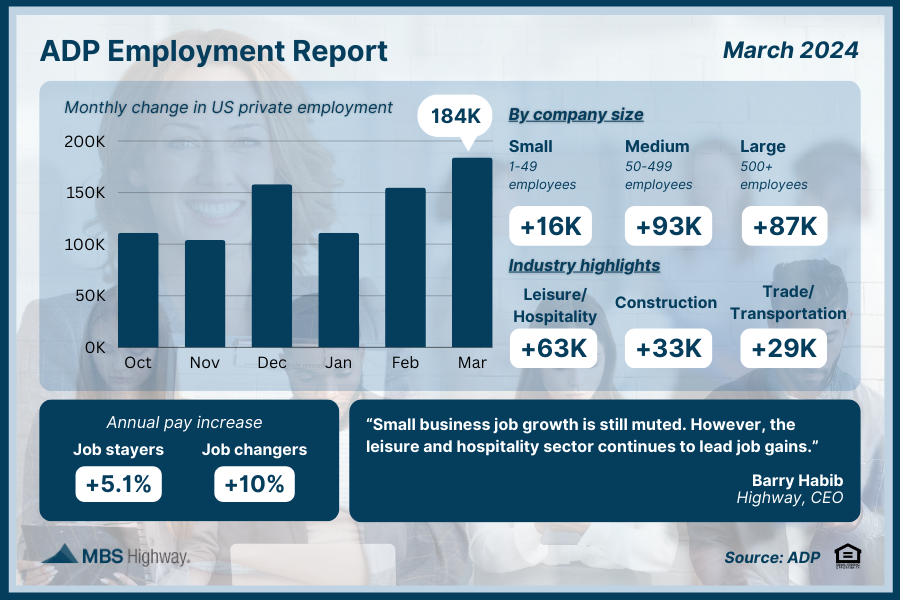

ADP’s Employment Report showed that private payrolls rose more than expected in March, led by a huge boost from the leisure and hospitality sector. Employers added 184,000 new jobs versus the 148,000 that had been forecasted, while job growth in February was also revised higher by 15,000 jobs. Growth among small businesses remained muted, however, as businesses with fewer than 50 employees only added 16,000 jobs.

What’s the bottom line? ADP noted that “last month saw the biggest jump in hiring since July,” with strong gains across all industries except professional services, where hiring fell.

Chief Economist Nela Richardson added that “inflation has been cooling, but our data shows pay is heating up in both goods and services.” On that note, annual pay gains for job stayers were flat at 5.1% after months of steady deceleration. The average increase for job changers “rose dramatically” from 7.6% in February to 10% last month, marking the second consecutive gain.

Strong Home Price Growth Continues

CoreLogic’s latest Home Price Index showed that national home values rose 0.7% from January to February, coming in much stronger than the flat monthly reading they had forecasted. Prices were also up 5.5% year over year.

What’s the bottom line? CoreLogic forecasts that home prices will rise 0.4% in March and 3.1% in the year going forward, though this will likely be revised higher as their forecasts are typically on the conservative side. For example, CoreLogic originally forecasted that we would see 3% appreciation in 2023 but we saw 5.5%. Plus going back to 2021, they had forecasted a 6.6% decline in home values, and we saw a nearly 19% gain instead.

The data from CoreLogic and other major home price indexes like Case-Shiller and the Federal Housing Finance Agency shows that price growth remains strong as we head into the busy spring buying season.

What to Look for This Week

We’ll see an update on consumer and wholesale inflation when the Consumer and Producer Price Indexes for March are reported on Wednesday and Thursday, respectively. Wednesday also brings the minutes from the Fed’s March meeting and an important 10-year Note auction, while the latest Jobless Claims and a 30-year Bond auction follow on Thursday.

Technical Picture

Mortgage Bonds tumbled Friday after the strong Jobs Report, ending last week trading near the bottom of a wide range with a ceiling at the 100-day Moving Average and a floor of support at 100.427. The 10-year was boosted higher in their wide range toward the 4.418% ceiling.

Disclaimer: This newsletter, provided by MBS Highway, offers general information about mortgages and real estate. LeaderOne Financial and Roller Mortgage Team are not responsible for decisions made based on this content. Readers are encouraged to independently verify information and seek professional advice before taking any actions related to mortgages or real estate.