Selling a House in Today’s Market

If news reports about the housing market cooling and buyer demand waning have you worried about selling a house in today’s market, read on. The outlook may not be as bad as the news outlets would have you believe. Buyer demand is still there; it’s just calmed a bit from the frenzy we’ve seen lately.

Buyer Demand Then vs Now

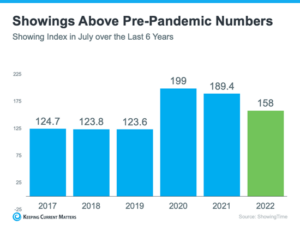

During the pandemic, mortgage rates hit record lows, which spurred a significant rise in buyer demand. As rates increased due to factors like rising inflation this year, buyer demand pulled back or softened as a result. However, when compared to data spanning the last six years, we see that buyer activity is actually higher now than it was pre-pandemic. This is fantastic news if you are thinking of selling a house in today’s market.

One way to get an accurate picture of buyer activity is to look at the number of showings. The graph below shows data from ShowingTime, the scheduling platform used by the vast majority of realtors.

This visual makes it clear that, while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. This goes to show there’s still demand if you’re considering selling a house in today’s market.

What it all means

The key to selling in a changing market is understanding that it’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed. While things have cooled a bit, it is still a sellers’ market, with a 1.5 month supply in the Kansas City Metro. If you work with a trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. The average time it takes a home to sell in the Greater Kansas City Metropolitan is 20 days.

The Takeaway

Buyer demand hasn’t disappeared, it’s just moderated this year and is still considerably higher than it was at this time of year pre-pandemic. Contact us today, and we can match you with a trusted real estate professional who will help you better understand how the market has shifted and how to plan accordingly for your sale.