Should you buy a home this year?

With the rise in mortgage rates and mounting economic concerns many people are questioning: should I buy a home this year? While it’s true 2022 has presented some unique challenges for homebuyers, it’s important to factor the long-term benefits of homeownership into your decision.

If you ask a group of people who bought their homes five, ten, or even thirty years ago, you’d be hard-pressed to find someone who regrets their decision. The reason? It is all about how you gain equity and wealth as home values grow over time.

Home equity is built up through price appreciation and by paying off the mortgage through principal payments.

Let’s take a detailed look at home price appreciation. It’s bound to be a deciding factor if you’re trying to decide whether or not to buy a home this year.

Home Price Growth and Your Decision to Buy a Home

Home values have increased significantly in recent years, despite the moderation we have seen in 2022. Data shows that in the last five years, home prices grew by

55% in Kansas and 60% in Missouri, while they increased 64% nationwide.

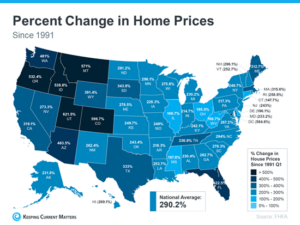

That means a home’s value can increase substantially in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains you stand to make become even clearer (see map below):

This map shows nationwide home prices appreciated by an average of over 290% over roughly a thirty-year span.

While home price growth varies by state and local area, the nationwide average tells you the typical homeowner who bought a house thirty years ago saw their home almost triple in value over that time. This is why homeowners who bought their homes years ago are still happy with their decision.

Even if home price appreciation eases as the market cools this year, experts say home prices are still expected to appreciate nationally in 2023. That means, in most markets, your home should grow in value over the next year even if the pace is slower than it was during the peak market frenzy when prices skyrocketed.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and fight annual lease hikes for no long-term financial benefit? Instead, consider buying a home. It’s an investment in your future that could set you up for long-term gains.

The Take-Away

Don’t let the shifting market delay your dreams. Data shows home values typically appreciate over time, and that gives your net worth a nice boost. If you’re ready to start your journey to homeownership, contact us and we will put you in touch with a local realtor today.