If you’ve been trying to decide whether or not to sell your house, recent headlines about home prices may be concerning. And if those stories have you wondering what it all means for your home’s value, here’s what you need to know about what’s really happening with home prices in the KC Metro.

It’s possible you’ve seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture. While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis.

It’s true home price growth has moderated in recent months as buyer demand has pulled back in response to higher mortgage rates, and this is what the headlines are drawing attention to today. But what’s important to notice is the bigger, longer-term picture.

While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

What Does This Mean for Your Home’s Equity?

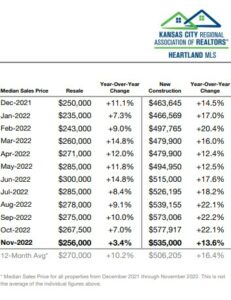

In the Kansas City Metropolitan area, your home’s value, on average, is up 10.2% over last year – and that gain is still dramatic compared to a more normal appreciation level of 3-4%.

The big takeaway? Don’t let the headlines get in the way of your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move. So what’s really happening with home prices in the KC Metro? All good things.

If you have questions about home prices or how much equity you have in your current home, give our team a call.